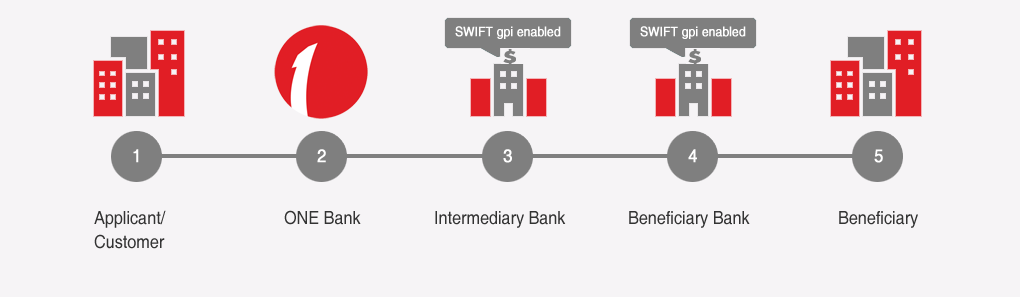

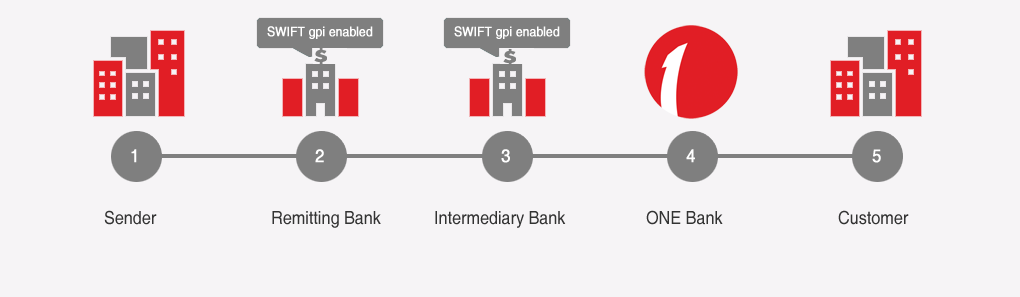

SWIFTgpi (Global Payments Innovation) is a new approach from SWIFT and was developed to increase the experience of making a payment for both customers and banks.

Through SWIFT gpi, we provide a faster and more transparent cross-border payment solution for our clients.

Faster Cross-border Payments

Faster Cross-border PaymentsEnhanced communication and higher standards for banks, that payments will be faster when the payments are completed in SWIFT gpi network. Bank’s customers can confirm their beneficiary/suppliers that they will receive cross-border payments within the same day.

Real-Time Traceability

Real-Time TraceabilityAll payments must have a Unique End-to-End Transaction Reference (UETR) which can be used to spot the funds at any point in real-time position.

Transparency on Fees

Transparency on FeesBanks that are part of the gpi network are required to provide transparencyon the processing fees, exchange rates and times, which will enable individuals to make better decisions.

Payment Confirmation

Payment ConfirmationNow, Bank’s clients can confirm the transaction when the payment reached to their supplier/beneficiary's account and to enhance trust in business relationship with them.

Consistent data records

Consistent data recordsBank initiates that all payment which are sent with the SWIFT gpi network will be unaltered all through the payments process. It is to allow beneficiaries/recipients to reconcile the payment instruction easily.

1. SWIFT gpi is a complimentary value-added service for ONE Bank Client.

2. SWIFT gpi information is dependent on gpi participation by banks.